Prof Ludovic Phalippou, Fellow in Finance at Queen’s and Professor of Financial Economics, has been at COP28 to participate in a panel discussion about how to help small and medium sized enterprises be more environmentally friendly. We asked him to tell us about some of the ideas and whether he thinks they go far enough.

What is the background to the discussion about SMEs?

There is a lot of money out there to help SMEs but we need to make sure it is channelled to the right ones.

When you advise banks to be bolder and to go further, what sorts of things do you mean?

Banks play a key role in directing the money that can help. The problem is that most of their green products are just feel-good investments at best. ESG-based lending is just about a few basis points lower interest rate. Banks need to stop this greenwashing and offer products that seek so-called additionality and therefore state that returns are concessionary (i.e. below market). Savers are ready for this, in my view, and it is what is necessary anyway.

What new ideas did you hear from other panellists?

I thought Climate Hub was a particularly interesting platform. It is new and growing fast and it is totally dedicated to helping SMEs with any climate-related issues.

How might a carbon tax help?

This would force everyone to internalise the externality they put on society. Overall people do react to higher prices, so taxing more high carbon emission products should make them less attractive. That said, there are limits to simple price incentives like this. For example, despite very high energy prices, some people still decide to open their windows wide and have their heaters running on maximum underneath.

Do you think there’s enough urgency in the current initiatives?

Not at all. There is a small group panicking and sometimes opting for extreme and unhelpful actions. There’s a wider group who would like to help but overall they are unsure how. And there is a large group who make a point of going against the tide as they get angry at what they perceive to be a ‘woke’ issue.

What’s the most important thing to change right now?

We need regulators to impose labels. For example, having a grade reflecting the carbon/methane footprint on each product should help. This type of extra cost is more difficult for SMEs to foot but technology may make that affordable.

If we have a carbon tax with revenue going to people who are negatively affected by the tax, it would be a great improvement. Also, educating people in Finance to eliminate greenwashing and more generally stop all the tricks designed to take advantage of the low general financial knowledge of the wider population.

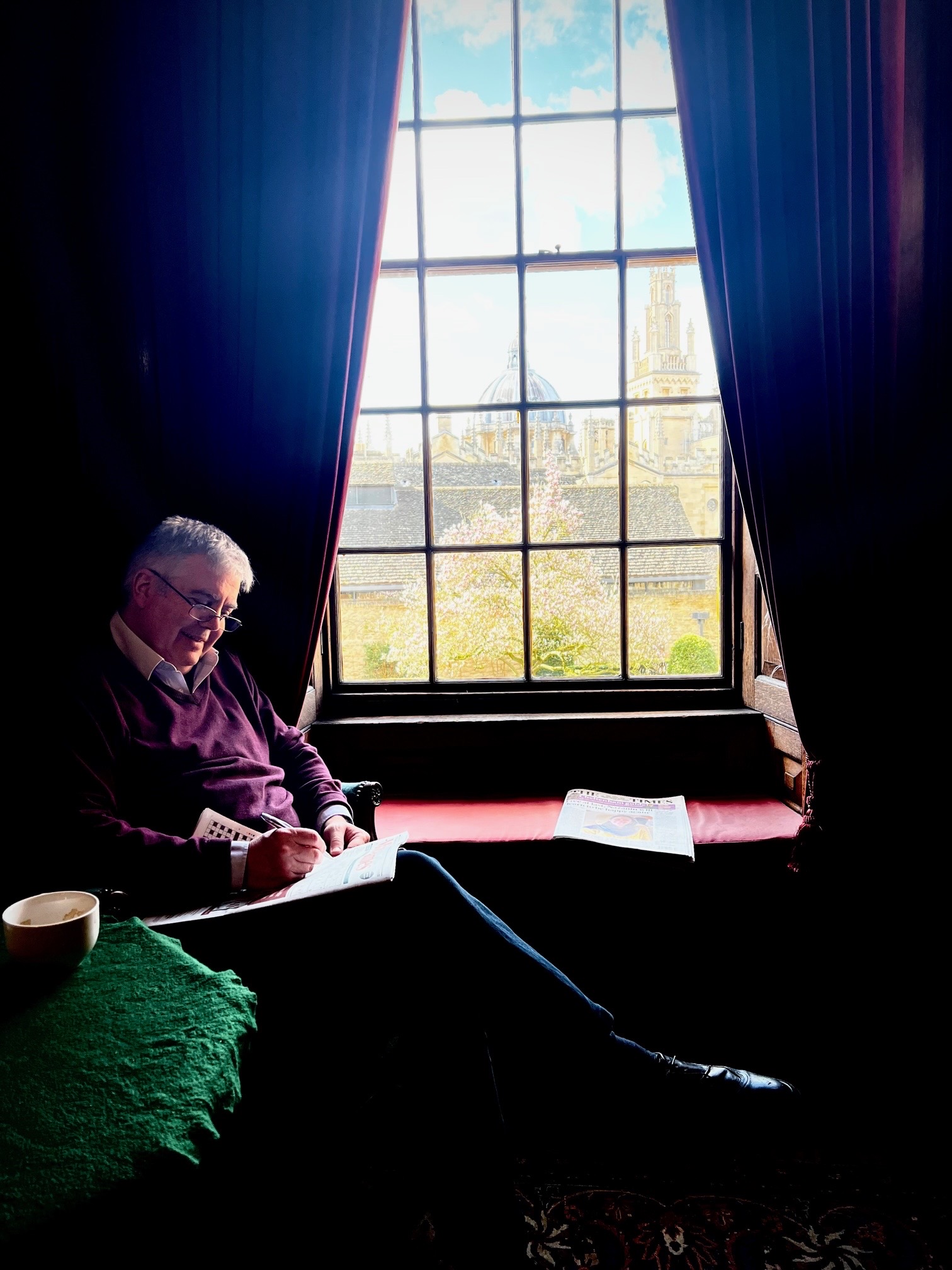

I have made a film illustrating what effective impact investing is like and the importance of knowing finance to achieve this. I am writing a book at the moment, which will hopefully reach out widely on this matter too.

We will share details of the film and book in 2024.