Competition Launch: The Anthea Bell Prize for Young Translators 2025-26

Fellow in Mathematics appointed Fellow of the Academy for the Mathematical Sciences

Current student is Musical Director of Sondheim’s ‘Company’ at Oxford Playhouse’

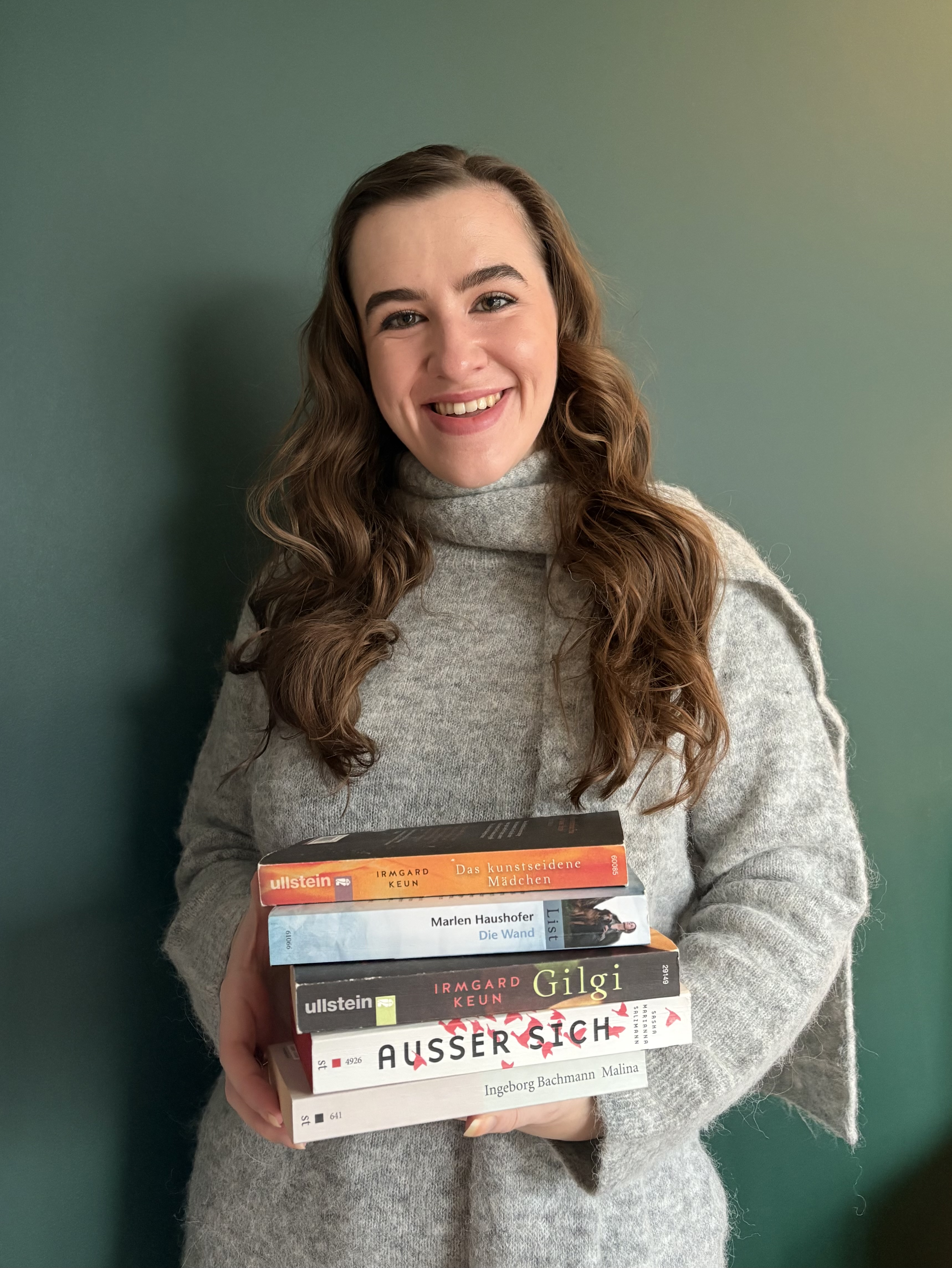

Lecturer in German wins the Women+ in German Studies book prize

Queen’s launches digital guide on Bloomberg Connects

Provost elected Fellow of the Royal Economic Society

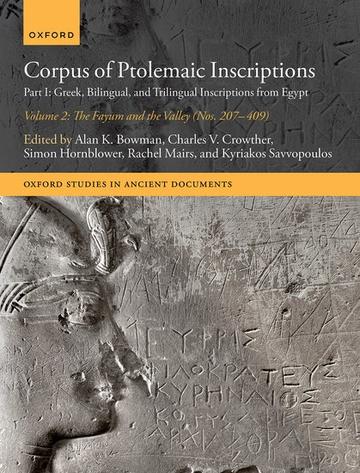

Fellow in Ancient History and Honorary Fellow edit new volume of multilingual inscriptions

Fellow in Materials Science awarded European Research Council grant

Fellow in Physics leads breakthrough in decades-long neutrino mystery

Mathematics student wins two University prizes

Medical student wins British Pharmacological Society Clinical Undergraduate Prize

Growing conversations: Movember at Queen’s

Fine press edition of Ancient Egyptian poem joins College Library

Professor Carrillo named Fellow of the American Mathematical Society

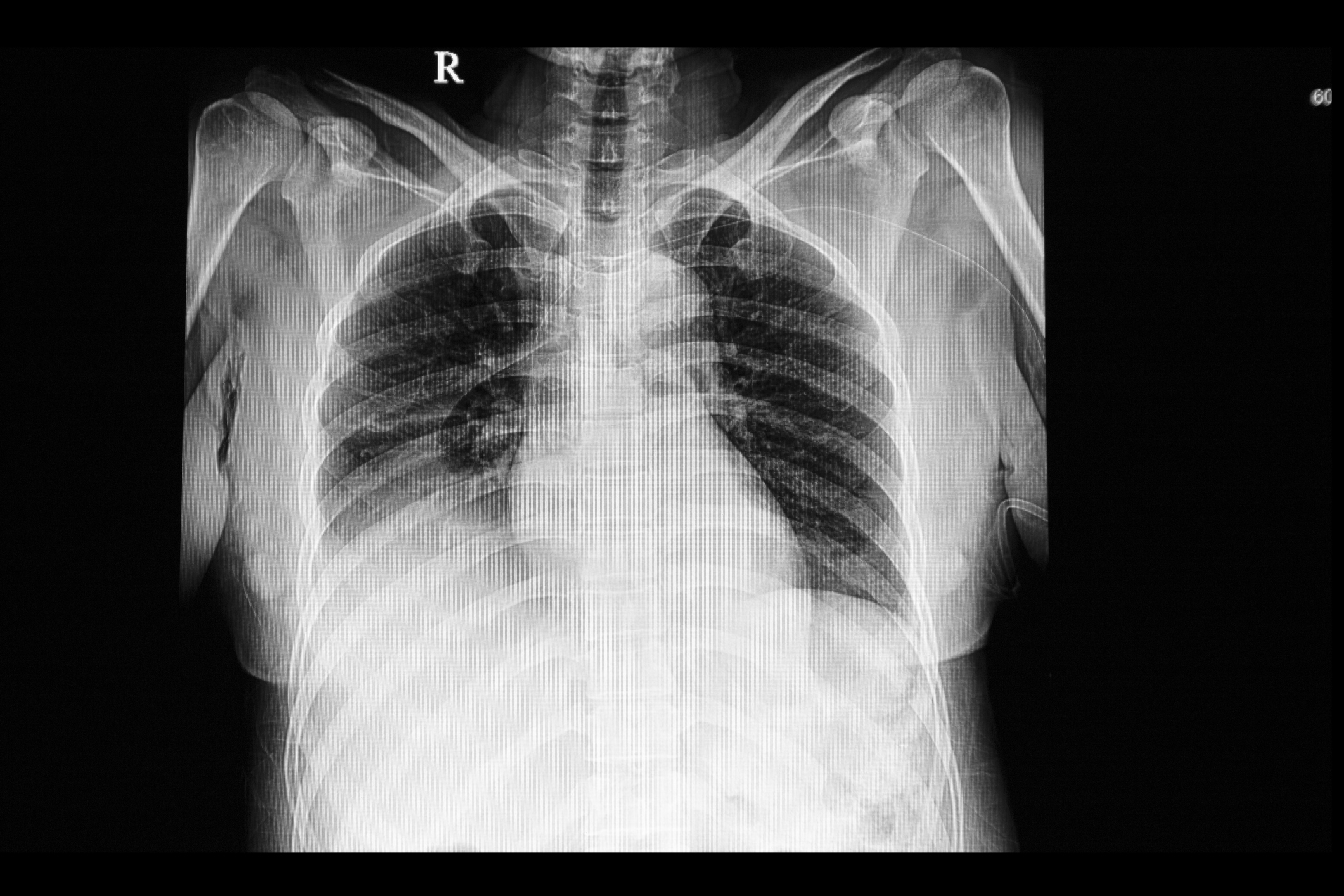

Pleural infection study points to earlier targeted treatment

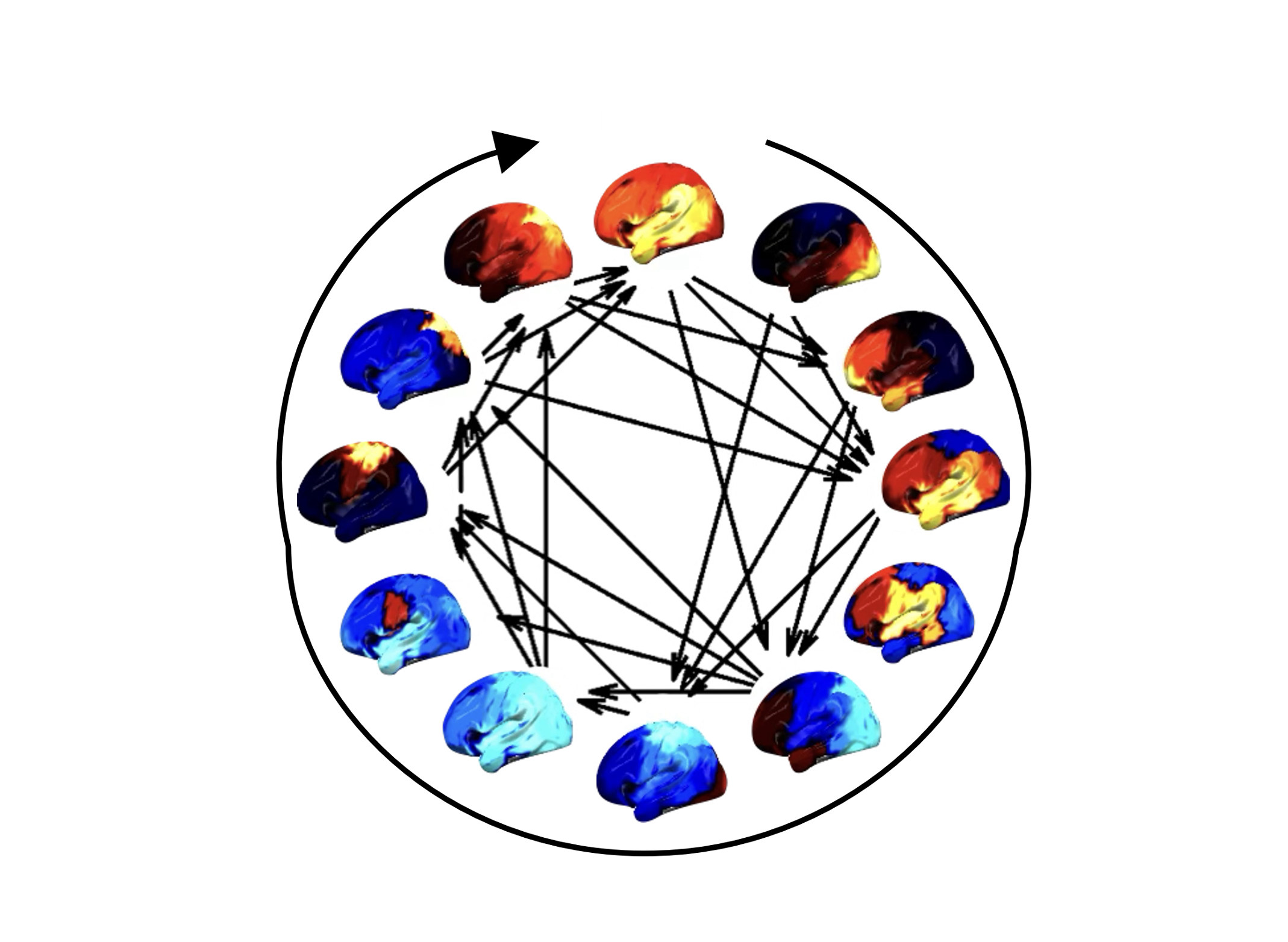

The brain keeps time: Queen’s researcher publishes new study in cognitive function